GETTING GREEN GRASS DOESN’T HAVE TO BREAK THE BANK

Arizona Turf Works has teamed up with Acorn Finance to offer flexible, customizable, and straight forward financing options. Buy Now, Pay Monthly

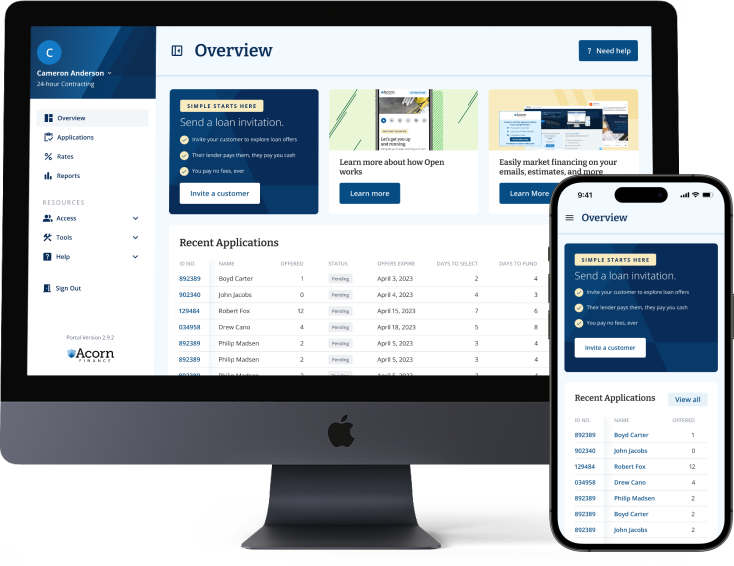

Acorn Finance and Arizona Turf Works have come together to offer a user-friendly platform that provides instant decisions. When you use Acorn Finance, you can receive prequalified offers within seconds without any negative effect on your credit score. Sorting through loan offers becomes effortless as you can prioritize what matters most to you—be it the interest rate, payment amount, or the length of the loan term.

In addition, you can compare rates from our network of trusted partners without impacting your credit score. Our exclusively online and customer-centric process aims to connect you with lenders who can promptly fund the creation of your lush and vibrant lawn.

FINANCE FAQs

-

Acorn Finance is a lending marketplace where the nation’s premier online consumer lenders pre-qualify customers for personalized loan options in 60 seconds, with no impact to the homeowner’s credit score. Acorn Finance uses an initial soft credit inquiry to provide access to competitive, fixed-rate loans through a fast and easy online process.

-

Depending on the lender that fits you best, you may be offered a personal loan or personal line of credit.

A personal loan lets you borrow money now and pay it back over time with fixed monthly payments. Personal loans have fixed rates of interest and typically have terms ranging from 2 to 12 years. They may be unsecured (no collateral) or secured (collateral required).

A personal line of credit allows you to borrow at any time based on a preset limit. As long as your account is open and your credit remains in good standing, you can borrow up to the maximum amount and pay interest only on the amount you actually borrow.

-

Acorn Finance's network of lenders offers loans from $2,000 to $100,000 for qualified borrowers.

-

Qualified applicants can be approved quickly during business hours and may receive their funds as soon as within 1 business day.

-

Acorn Finance's lenders charge no penalties for early repayment, and no processing fees on loans of more than $40,000. If you borrow less than $40,000, some lenders may charge an origination fee between 1-6%. You’ll see no-fee options clearly highlighted on your offers pages, so you can make a fully informed choice.

-

Yes. Co-borrowers are encouraged to apply, and can be added immediately after the initial applicant submits their information.

OUR TOP NATIONAL LENDERS AND PARTNERS

Questions? We have all the answers!

Our team is dedicated to providing you with comprehensive answers to all your inquiries about artificial turf. Don't let unanswered questions hold you back from achieving the lawn of your dreams. Contact Arizona Turf Works today and experience the power of knowledge!